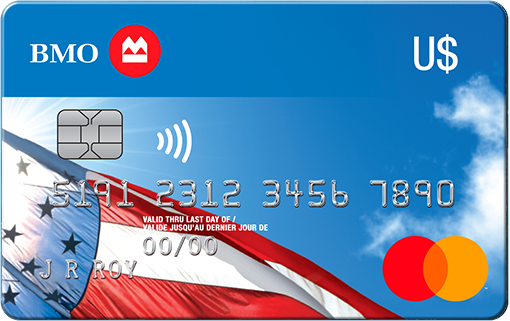

The BMO U.S. Dollar Mastercard® is a credit card offered by the Bank of Montreal (BMO) that is designed specifically for Canadian residents who frequently travel or make purchases in the United States. This credit card is denominated in U.S. dollars, which allows cardholders to avoid foreign currency exchange fees when making transactions in the U.S.

One of the key features of the BMO U.S. Dollar Mastercard® is its ability to save money on foreign exchange fees. When Canadian cardholders use a regular credit card for purchases in U.S. dollars, they are typically subject to a foreign exchange fee, which can range from 2% to 3.5% of the transaction amount. With this card, however, cardholders can make purchases in U.S. dollars without incurring any foreign exchange fees, saving them money in the process.

In addition to the savings on foreign exchange fees, the BMO U.S. Dollar Mastercard® offers several other benefits. These include:

1. No annual fee: Cardholders do not have to pay an annual fee to maintain the card, making it a cost-effective option for frequent travelers or individuals who regularly make purchases in U.S. dollars.

2. Competitive interest rates: The card offers competitive interest rates on purchases and cash advances, which can help cardholders save money on interest charges if they carry a balance.

3. Purchase protection and extended warranty: The card provides purchase protection, which covers eligible items purchased with the card against theft, loss, or damage for a specific period after purchase. It also extends the manufacturer’s warranty on eligible items, providing additional coverage.

4. Travel benefits: The BMO U.S. Dollar Mastercard® offers various travel benefits, including rental car collision/loss damage insurance, travel medical insurance, and trip cancellation/interruption insurance. These benefits can provide peace of mind and save cardholders money on additional insurance coverage.

5. Mastercard benefits: As a Mastercard-branded credit card, the BMO U.S. Dollar Mastercard® provides access to a range of Mastercard benefits and services, such as Mastercard Global Service for emergency card replacement or cash advances, Mastercard Zero Liability Protection for unauthorized transactions, and Mastercard Priceless Cities offers and experiences.

6. Online and mobile banking: Cardholders can manage their BMO U.S. Dollar Mastercard® account online or through the BMO mobile banking app. This allows for convenient access to account information, transaction history, payment options, and more.

It’s worth noting that while the BMO U.S. Dollar Mastercard® offers many advantages, it may not be suitable for everyone. Cardholders should carefully consider their individual financial needs and spending habits before applying for this card.